How does basic life and ad&d work? Through the life claim process.

Group term life/ad&d insurance provides death benefits for employees covered under basic employee benefit plans.

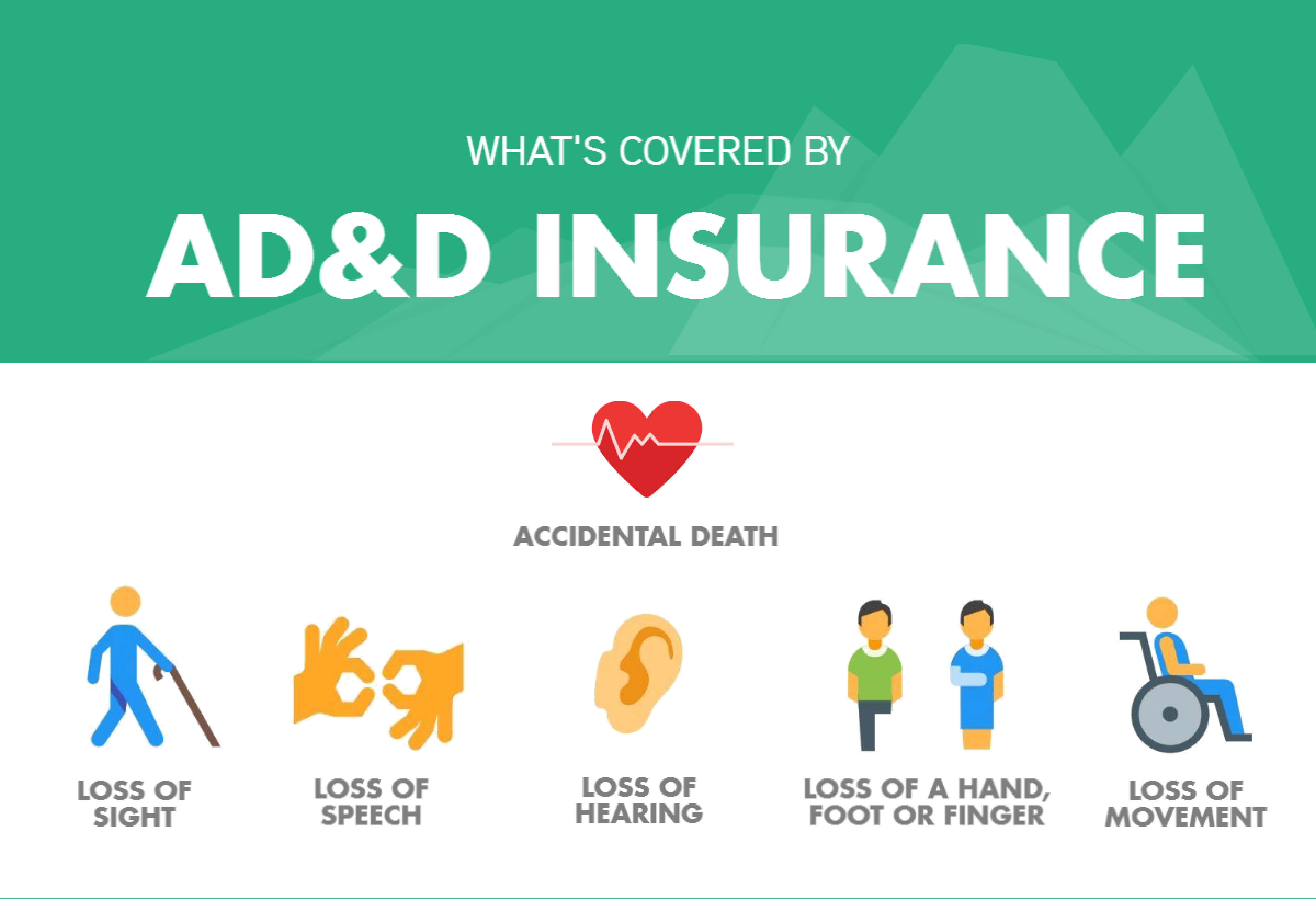

What is basic life and basic ad&d. • your employer provides you with accidental death and dismemberment insurance in an amount equal to your basic life coverage and broken into two categories. What is basic ad&d life insurance? Pay expenses resulting from a serious injury, such as the loss of a limb.

You are automatically enrolled for $5,000 if you have a qualified dependent spouse/domestic partner. Funeral, burial and probate costs. Basic life and ad&d insurance are the names often used when offering supplemental insurance to employees.

And one hand or one foot and loss of sight in an eye, or loss of your speech and hearing. Provide your employees with valuable life insurance benefits at a cost that is typically lower than individual coverage. N spouse/domestic partner basic term life:

Basic life refers to life insurance that would pay the death benefit to the beneficiary if death occurred by any reason (except suicide in the first two years). This additional benefit doubles the value of your life insurance coverage if you die in an accident. Provide for your loved ones when you’re no longer.

Ad&d coverage amounts for you: Explaining basic and voluntary plans. Life insurance pays a benefit directly to any beneficiaries you choose, such as your spouse, partner, children or other loved ones.

Basic ad&d coverage amounts are paid in the event of accidental loss of life; Employees can also purchase additional life and ad&d through a voluntary life insurance option; The basic employee life and supplemental employee life policies have an ad&d (accidental death & dismemberment) rider.

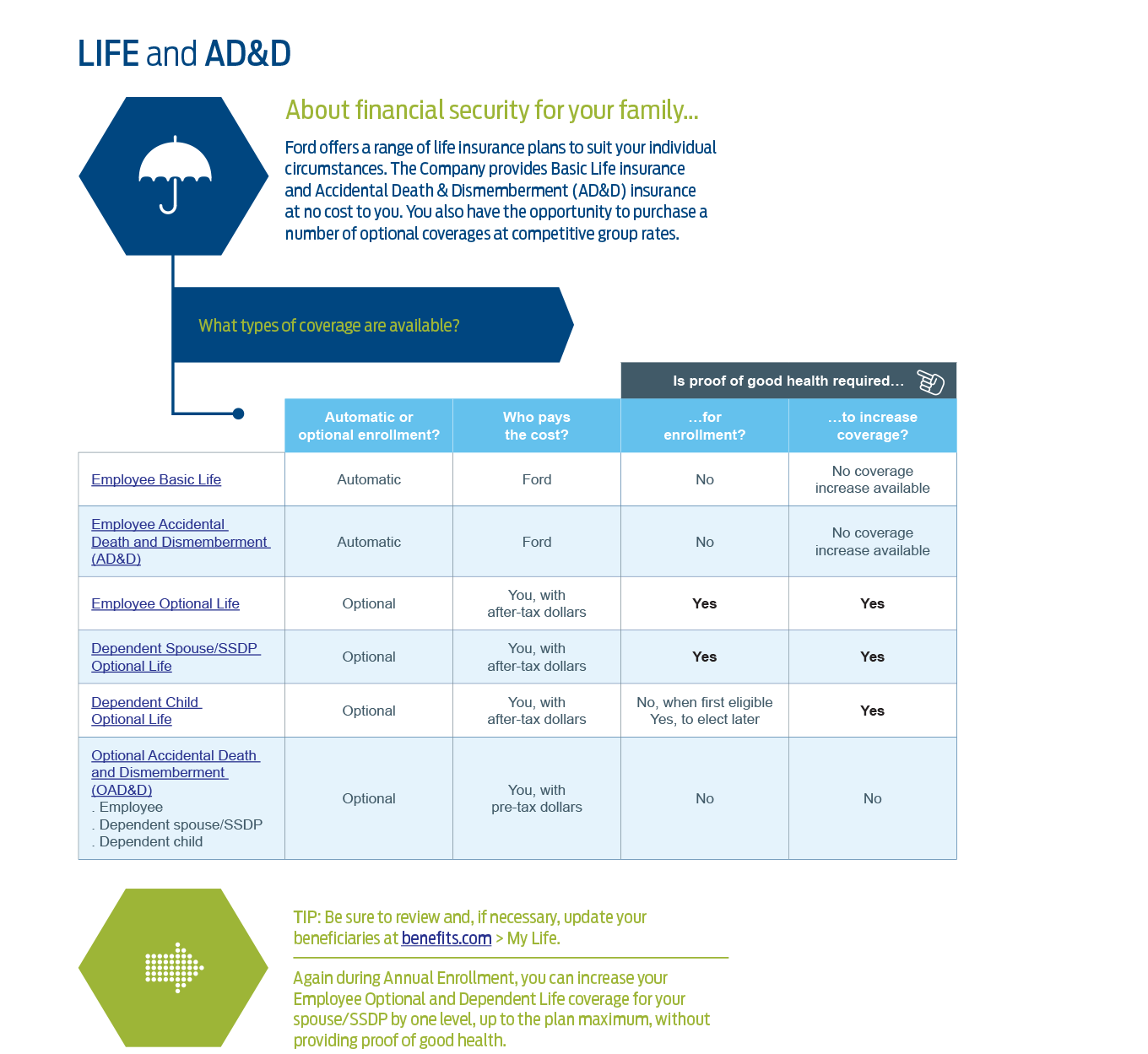

These benefits can be used to: While basic life and ad&d typically only covers employees, organizations can offer voluntary life and ad&d coverage for spouses and dependent children. What is life ad&d benefit?

One hand and one foot; Ad&d coverage also provides benefits if you survive an accidental injury but lose the use of a body part (such as the loss of an eye or limb). Accidental death & dismemberment (ad&d) insurance pays a benefit to you or your beneficiaries if you die or experience severe injuries as the result of an accident.

This means that the insured person could pass away from illness, accident, or old age and the policy would pay the death benefit to the beneficiary. Your life and ad&d benefits optional life and ad&d enrollment new employees in order to enroll in the optional life and ad&d insurance program, you must first be enrolled in basic life and ad&d insurance. Basic life and ad&d insurance inova provides basic life insurance to assist you and your family in the event of a death or dismemberment.

As a stanford employee, you are automatically enrolled in our basic life insurance program. New employees may apply for up to eight times their salary when first eligible. It can also help cover costs such as:

The amount of optional life and ad&d insurance you may elect is up to you and is based on a. The amount of benefit is equal to one times your annual compensation, rounded to the next higher $1,000, if not already a multiple thereof. Short term disability (std) provides paycheck protection for employees.

In part, life insurance may help provide replacement income for your family. Basic plans are mandatory in zenefits and employers typically cover the plan's premium costs for their employees. Basic life, supplemental life and ad&d rates.

Basic life & ad&d plan + voluntary life & ad&d plan; An accidental death and dismemberment (ad&d) insurance policy can help protect your family’s finances in the event of the loss of your life or limb (s). You are automatically enrolled for two times your covered annual earnings* to $500,000.

Qualified groups can also add fmla administration to their std coverage. We provide basic life insurance, plus the opportunity to purchase supplemental life insurance. Basic life insurance and ad&d.

What makes it a basic policy is that it is simple in the fact that you pay for a specific amount of coverage for a certain amount of time. It can be an affordable way to supplement your life insurance or medical coverage if you’re seriously injured or die as a. Employers can generally choose to offer.

Lifekeys® services, which provide access to counseling, financial, and legal support services. Supplemental group life and ad&d our supplemental life offers the same features found in our basic group life policy, while giving employees the flexibility to purchase more benefit based on their needs. These benefits are fully paid by the company and coverage is automatic — you do not need to enroll.

Ad&d stands for accidental death and dismemberment insurance. Accidental death and dismemberment affords coverage for specific losses sustained as a result of any injury, subject to certain time limitations and exclusions. Coverage reduces by 50% at age 70.

Basic life insurance is a simple life insurance policy, often offered as part of a benefits package at a company along with group health insurance, paid time off and more. The amount of benefit is equal to one times your annual compensation, rounded to the next higher $1,000, if not already a multiple thereof. Basic term life and ad&d insurance—100% employer paid n employee basic term life:

Add&d stands for accidental death and dismemberment. Basic life insurance cover death by any reason. Taxes and debts, such as credit card balances.

Companies often offer basic life insurance to their employees on a free or very inexpensive basis. $15,000 seat belt benefit may also be payable if you die in an automobile accident. What is basic life and add?

With basic plans, employees are automatically enrolled in life insurance when they join the company. $15,000 of accidental death and dismemberment (ad&d) insurance. You are automatically covered for $15,000 of basic life insurance provided by the hartford at no cost to you.

There is no cost to employees for basic life and coverage is 1x salary up to a max of $50,000. Coverage is the amount equal to 1 times base annual earnings, to a maximum of $500,000.

Accidental Death Dismemberment Add – Texas Bar Private Insurance Exchange

Gaz9 The Minrothad Guilds Basic – Wizards Of The Coast Dd Basic Mapsterr Dungeons And Dragons Adventures Dungeons And Dragons Dungeons And Dragons Game

Voluntary Life Insurance Quickquote

Now That Im Running A 5th Edition Classic Greyhawk Campaign Im Trying To Stir Some Add Flavor Into 5th Edition Withou Fantasy Races Fantasy Artwork Fantasy

Immagine Correlata Character Art Fantasy Artwork Fantasy Warrior

Supplemental Life And Add Coverage Expanded For 2019 Hub

5 Star Life – Basic Life And Addvoluntary Group Term Life Insurance

Old School Frp Fantasy Artwork Dungeons And Dragons Character Art

Shirtoid Roleplaying Game Dungeons And Dragons Dungeons And Dragons Art

The Brief Adventures Of Aleena The Cleric Larry Elmore Frank Mentzers Basic Dd Players Manual Tsr 19 Dungeons And Dragons Art Fantasy Artwork Fantasy Art

Fr1 Waterdeep And The North 1e – Wizards Of The Coast Add 2nd Ed Forgotten Realms Advanced Dungeons And Dragons Forgotten Realms Dungeons And Dragons

Kobolds Advanced Dungeons And Dragons Dungeons And Dragons Classic Rpg

Old School Frp Concept Art Characters Fantasy Theme Funky Art

Basic Lifeadd Life Disability Goldbelt Inc

Gaz10 The Orcs Of Thar Basic – Wizards Of The Coast Dd Basic Add 1st Ed Drivethrurpgco Dungeons And Dragons Art Fantasy Artist Fantasy Illustration