Modified whole life insurance is a whole life insurance policy with a waiting period. Modified life insurance, also commonly modified whole life insurance, is a unique form of permanent life insurance that offers a much lower premium for the first few policy years in exchange for a higher premium after an introductory period.

Lic Bima Jyoti Plan No 860 Features Eligibility Benefits And Review In 2021 Life Insurance Policy Health Insurance Companies Individual Health Insurance

Just like whole life insurance, modified policies cover the insured.

What is modified whole life insurance policy. Modified whole life insurance is a type of whole life coverage that offers an alternative premium structure to purchasers who wish to lay out less money for premiums in the first few years of the policy. What does modified whole life insurance mean? In short, the premiums are lower during the first 5 years of the policy and then increase to a specified amount for the remaining life of the policy.

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Modified whole life policies are whole life policies that feature a different premium structure to make them more affordable during the early life of the policy. Final expense insurance is also called “funeral insurance.

Modified whole life insurance is a whole life insurance policy with a waiting period. What is a modified premium whole life insurance policy? A less costly alternative is modified whole life insurance, which can make a whole life policy more affordable.

If the insured were to die during the waiting period, the insurance company will only refund premiums paid plus interest. This period of lower premiums usually lasts through the first five to ten years of a policy’s life, depending upon the issuing company. During the waiting period, which is usually 2 to 3 years, you have no death benefits.

In short, the premiums are lower during the first 5 years of the policy and then increase to a specified amount for the remaining life of the policy. Modified whole life insurance can also be called → graded life insurance →. The modified premium whole life policy is used for offering comprehensive protection and coverage for the rest of one's life.

Modified whole life insurance is a type of whole life insurance that offers lower premiums for a short time (usually two to three years), followed by a higher rate for the remainder of the policy. At this point, cash value starts accumulating like a. With a modified premium whole life insurance contract, the amount of premium due is lower in the first years of the policy.

“modified” whole life insurance has an initial “modified” level of coverage that typically lasts a specific number of years at the beginning of the insurance policy. Modified premium whole life insurance is also known as modified whole life or graded life insurance. It offers a guaranteed death benefit, builds cash value, and provides security for your growing family.

The main difference between whole life and modified whole life is that modified whole life allows more flexibility with premium payments in the beginning of the policy, so that you. If you die within that time, the insurance company refunds the premiums you’ve paid plus a set interest rate, usually around 8. After the period of lower premiums expires, the cost of the policy is typically a bit higher than a traditional level.

The initial savings may be tempting, but it’s not the best life insurance policy for most people because of the high premiums and complicated policy options. After the waiting period is over, the full benefit is payable for any reason. For example, a $1 million modified whole life insurance policy might cost a low introductory premium of $1,000 per year, and then the premium goes up to $10,000 per year after the first five years.

Modified policies start out at a specified premium for the first five years, and then the premium rises to another specified amount for the remainder of the policy. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Premiums usually start lower, then increase after five to 10 years.

Modified life insurance is any policy with an alternative premium payment structure. Final expense insurance is a whole life insurance policy that has a small death benefit and is easier to get approved for. Modified whole life insurance is very similar to whole life.

Modified whole life insurance is the most common type but modified term life insurance also exists.

Pin By Meghan Jamesh On Businesses Services In 2021 Life Insurance Policy Life Insurance Term Life

Colonial Penn Life Insurance Company – Thanks Jonathan 15 – Video 2 – Youtube Life Insurance Companies Colonial Penn Life Insurance

Term Life Vs Whole Life Insurance Understanding The Difference

Common Types Of Life Insurance Infographic Life And Health Insurance Life Insurance Marketing Life Insurance Quotes

Modified Endowment Contract Mec – Understand How It Benefits You

Pin On Life Insurance For Seniors Quotes

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

Difference Between Universal And Whole Life Insurance With Table Ask Any Difference

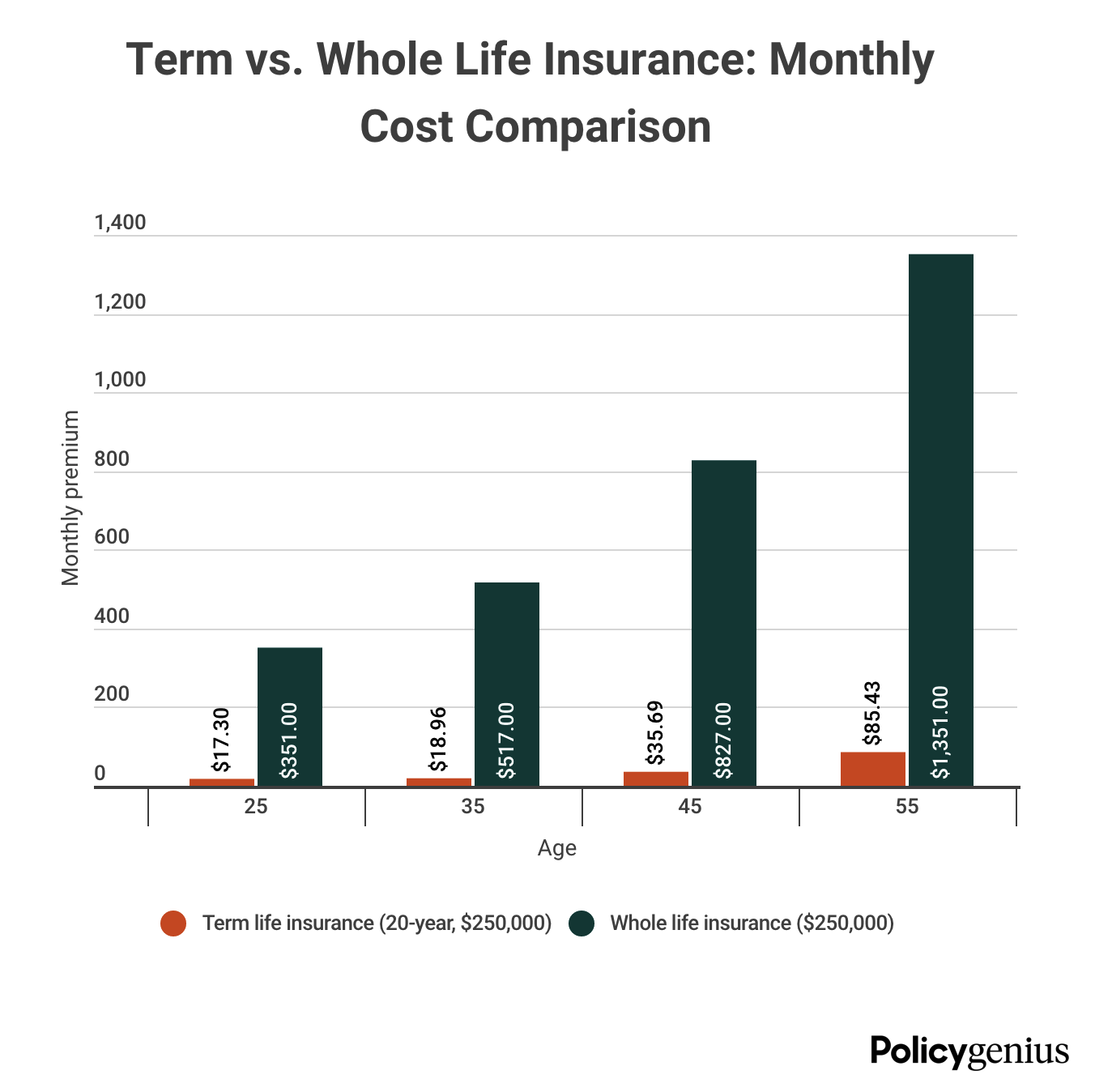

Term Vs Whole Life Insurance Policygenius

Types Of Whole Life Insurance Life Insurance For Seniors Family Life Insurance Life Insurance Quotes

Pin On Mutual Of Omaha Living Promise Review

Pin By Buyonlinelic On Insurance Investment Insurance Investments Life Insurance Marketing Insurance Marketing

Whole Life Insurance – Definition And Meaning – Market Business News

Whole Life Insurance – Definition And Meaning – Market Business News

How Does Whole Life Insurance Work Costs Types Faqs

Ultimate Guide To Selling Final Expense Insurance Updated For 2019 Final Expense Insurance Final Expense Things To Sell

Annuity Vs Life Insurance Similar Contracts Different Goals

Life Insurance Comparison Excel Five Disadvantages Of Life Insurance Comparison Excel A Life Insurance Comparison Insurance Comparison Life Insurance Policy