An insurable interest in something exists when damage to that thing would cause. You need to have an insurable interest to take out a life insurance policy on someone else.

When Does Insurable Interest Exist In A Life Insurance

When must insurable interest exist for a life insurance contract.

When must an insurable interest exist for a life insurance claim. In short, the party acquiring the life insurance contract must be expected to suffer a financial loss from the insured's death. Insurable interest is a nonnegotiable aspect of life insurance policies. What is insurable interest in life insurance?

For example, if a creditor takes out a policy on the life of a debtor and subsequently the debtor pays back the loan, nevertheless, the creditor can continue the policy as per original terms and shall be entitled to sum assured either on death of the debtor or on maturity, even. Insurers decide if the insurable interest exists before entering into the insurance contact. In every single contract of life insurance, an insurable interest must exist.

Insurable interest must exist only at the time the applicant enters into a life insurance contract. If no insurable interest exists when a policyowner buys a life insurance policy, the contract may still be enforced. It must continue for the life of the policy.

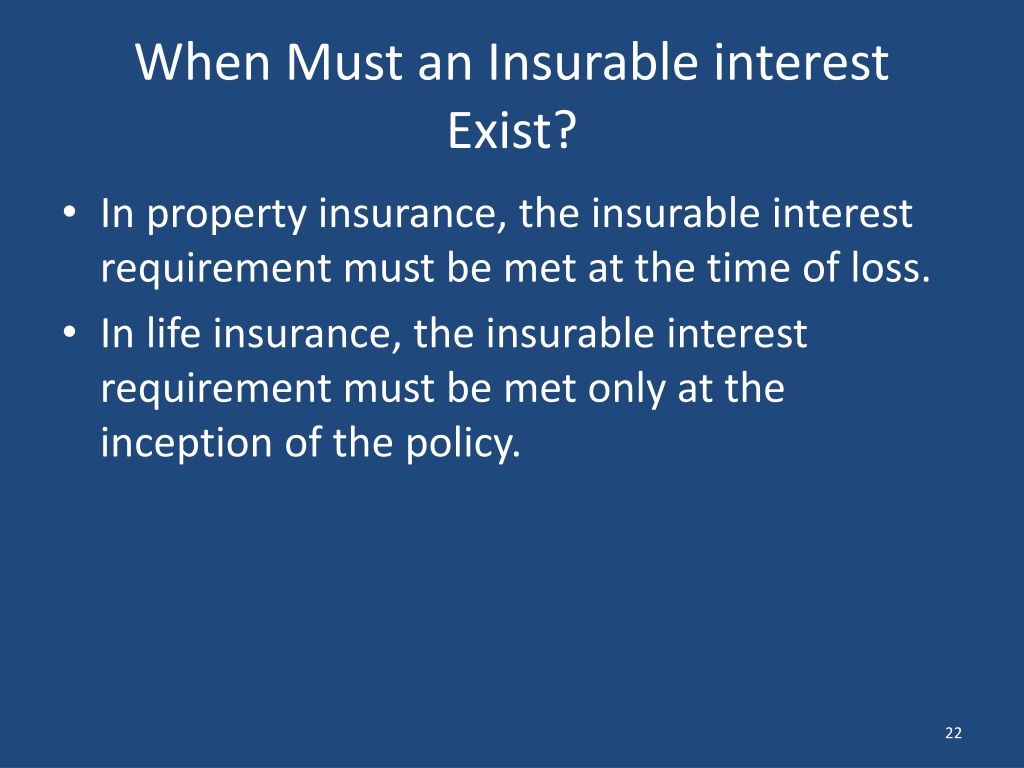

The main problem with insurable interest concerns the time at which the interest must attach; It must exist when a claim is submitted. Insurable interest means you have an interest in the continuation of the life of the person who’s insured—it could be financial and/or emotional.

If no insurable interest exists when a policyowner buys a life insurance policy, the contract may still be enforced. Insurable interest must exist only at the time the applicant enters into a life insurance contract. As a general rule, the assured must, at the time of the loss, have an insurable interest in the subject matter insured.

Where the insurable interest is created under categories 2, 3 and 4 above, the amount that can be insured is limited to the amount of interest the policyholder has in the life insured. (below, we’ve included insurable interest examples of the people who can typically claim insurable interest.) You automatically have an unlimited insurable interest in your own life.

The interest must exist at the time the policy is taken out. The policy owner is the person who owns the life insurance policy. It is the duty of the policy owner to prove that they have an insurable interest in the insured party.

In order to buy a policy on your life, the policy owner must show life insurance insurable interest. You can't take a life insurance policy out on just anyone. When must insurable interest exist in a life insurance policy?

Insurable interest is the basis of all insurance policies. If there is an insufficient insurable interest between the policyholder and the insured, the policy is voided. Insurable interest must exist at the time of effecting the policy and it may not exist at the time of claim.

Life insurance policies always have an insurable interest requirement. In order to purchase a policy, insurable interest must exist. In contracts of international sale of goods, it is not always easy to ascertain at any given time whether the property has in fact.

It must exist when a claim is submitted. The applicant must reasonably expect a benefit or advantage from the continued life of the insured or loss when that life ends. In the case of a life insurance policy, the owner of the policy must always have an insurable interest in.

Insurable interest can be an object which, if damaged or destroyed, would result in financial hardship for the policyholder. It must continue for the life of the policy. It must exist when a claim is submitted.

PPT Chapter 9 PowerPoint Presentation, free download