A trust is a legal entity and can be an owner of a life insurance policy, named a beneficiary, or both as long as the trust has an insurable interest to the insured. It must continue for the life of the policy.

Life insurance policies always have an insurable interest requirement.

When was insurable interest exist in a life insurance policy. We’ll take a closer look at what insurable interest is, when it’s necessary for a life insurance. If no insurable interest exists when a policyowner buys a life insurance policy, the contract may still be enforced. If no insurable interest exists when a policyowner buys a life insurance policy, the contract may still be enforced.

Chapter 2 life insurance, general insurance, & insurable interest 2.1 life insurance & insurable interest life insurance is the protection against financial loss resulting from the premature death of an insured. Some people might be inclined to. If no insurable interest exists when a policyowner buys a life insurance policy, the contract may still be enforced.

It must continue for the life of the policy. In certain situations the courts have held that insurable interest exists where the general principles discussed above would indicate otherwise. It must exist when a claim is submitted.

Insurable interest must exist both at the time of effecting the policy and at the time of claim. In terms of life insurance, it means that you would financially suffer if the person who’s insured died. It must continue for the life of the policy.

Therefore, if you would like to financially protect someone that does not have an insurable interest in your life, you can purchase a life insurance policy on your life, naming that person as the beneficiary (the most common. Always, but it's a requirement that applies to the owner with the person being insured. Insurable interest must exist at the time of effecting the policy and it may not exist at the time of claim.

(below, we’ve included insurable interest examples of the people who can typically claim insurable interest.) The named beneficiary receives the proceeds and thereby safeguarded from the financial impact of the death of the insured. It must exist when a claim is submitted.

It must exist when a claim is submitted. Insurable interest must exist only at the time the applicant enters into a life insurance contract. How ever to the extent of my knowledge being fiii from insurance institute of india i will try to give you some clarity on the concept.

When must insurable interest exist in a life insurance policy? If no insurable interest exists when a policyowner buys a life insurance policy , the contract may still be enforced. When must insurable interest exist in a life insurance policy?

In order to buy a policy on your life, the policy owner must show life insurance insurable interest. For example, if a creditor takes out a policy on the life of a debtor and subsequently the debtor pays back the loan, nevertheless, the creditor can continue the policy as per original. It must continue for the life of the policy.

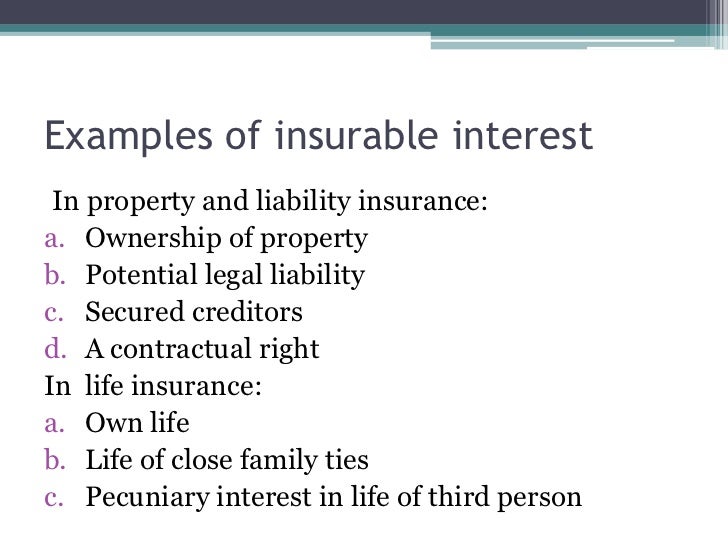

In life insurance, a person would have an insurable interest if the death of the insured would result in a financial or otherwise significant loss. Insurable interest is interest of the life assur. If you aren’t sure whether you have insurable interest in someone, this article will cover what insurable interest is, how to prove it and examples of when insurable interest does.

Why must insurable interest exist? Insurable interest is a requirement for all life insurance policy owners, which makes it crucial to identify. Insurable interest must exist only at the time the applicant enters into a life insurance contract.

Cases where the court has defined the subject matter as a particular life of a particular person and where the insurance is to recover a sum on the death of that person. It’s important because it helps prevent insurance fraud. Insurable interest is an economic stake in an event for which a person or entity purchases an insurance policy to mitigate the risk of loss.

In life insurance, insurable interest refers to what level of loss you’d experience should a specific person become incapacitated or die. Insurable interest must exist only at the time the applicant enters into a life insurance contract. Insurable interest must exist only at the time the applicant enters into a life insurance contract.

Insurable interest must exist only at the time the applicant enters into a life insurance contract. When must insurable interest exist in a life insurance policy quizlet? It must continue for the life of the policy.

If no insurable interest exists when a policyowner buys a life insurance policy, the contract may still be enforced. Hi, unfortunately there is no legal evidence to define what exactly is insurable interest? In life insurance policy, an individual has an ‘insurable interest’ in the life of one more if she or he is worried as well as straight influenced by the continuation of the life of that individual (the guaranteed), at the very least at the time the insurance policy is impacted.

Insurable interest is defined as having a reasonable expectation that you’d suffer a financial loss if the event you’re trying to insure against occurs. Insurable interest in life insurance refers to the fact you’d experience loss—either financial or emotional—if the insured person passes away. It protects human life and also prevents people from buying life insurance as a form of gambling on someone else’s death solely for financial gain.

When Does Insurable Interest Exist In A Life Insurance

When Was Insurable Interest Exist In A Life Insurance

When Does Insurable Interest Exist In A Life Insurance

When Does Insurable Interest Exist In A Life Insurance

When Must An Insurable Interest Exist For A Life Insurance

When Does Insurable Interest Exist In A Life Insurance