A guarantor is a third party in a contract who promises to pay for certain liabilities if one of the other parties in the contract defaults on their obligations. Guarantors sometimes appear on insurance contracts and also provide a sort of insurance themselves.

Student Rooms near Northumbria University

A guarantor is a financial term describing an individual who promises to pay a borrower's debt in the event that the borrower defaults on their loan obligation.

Who is a guarantor in insurance. • the guarantor is always the patient, unless the patient is a minor or an incapacitated adult. The person who ultimately accepts financial responsibility to pay the patient’s bill. My soon to be ex wife was the patient and the one who signed as the guarantor on the hospital forms.

A property and casualty insurance company licensed in new york and other states. With self funded health insurance your employer or union is the guarantor and they may have reinsurance in place to back them. Who classifies as a guarantor?

I was only the health insurance policy holder. Answered on may 7, 2013. Guarantor insure was established by tim wakelin after his son asked him to act as his student guarantor.

Is a guarantor an insurance company? Who is a guarantor in insurance? Therefore, the party or person guarantees that whatever promises made by the first party will be fulfilled.

Guarantors pledge their own assets. Guarantid offers protection against any unpaid financial loss or damage incurred by you as part of a tenancy agreement. The contract between the patient and the health insurance provider.

A guarantor (orresponsible party) is the person held accountable for the patient’s bill. The contract between a health insurance company and the insured individual. Who is the guarantor for insurance?

The insurent® lease guaranty program is underwritten and issued by argonaut insurance company, a property and casualty insurance company rated a (excellent) by a.m. A guarantor is a third party in a contract who promises to pay for certain liabilities if one of the other parties in the contract defaults on their obligations. The health insurance company is a guarantor of sorts (if you have a fully insured plan) but there may also be other carriers backing them up.

The person who ultimately accepts financial responsibility to pay the patient’s bill. According to wellspan health, the guarantor is the person legally responsible for charges incurred. In most cases it is the adult patient receiving the service.

But if, for some reason, the first party fails to fulfill the promises, the guarantor should shoulder the liabilities. An adult over the age of 18 may not be listed as her own guarantor if she is a college student and remains under her parents’ health insurance plan or if she is mentally. If the patient is a child, the responsible party may be the child’s parent or legal guardian.

The three main companies providing guarantor services are insurent, the guarantors, and leapeasy. A discussion about health insurance guarantors might refer to: Therefore, guarantor insurance for rent is an added layer of protection for the landlord in case of default by the tenant.

Using professional guarantor insurance is a popular option for those who cannot find a guarantor within their personal network. A guarantor is a person who “guarantees” your identity. I am currently being sued for a $4000 + hospital bill that i did not sign as the guarantor or anything on.

Best and licensed in new york and 48 other states. Who is guarantor medical insurance? I was not the patient and i did not sign anything.

He or she must be a person who has known you personally for at least two years. There are a couple of different answers when it comes to talking about health insurance. A person over the age of 18 is typically listed as her own guarantor.

In most cases it is the adult patient receiving the service. • the guarantor is not the insurance subscriber, the husband, or the head of household. Guarantors sometimes appear on insurance contracts and also provide a sort of insurance themselves.

Guarantor insure was established by tim wakelin after his son asked him to act as his student guarantor. A guarantor is someone who is willing to cosign on an application, making them responsible for any debt that is left unpaid. The guarantor is the person who is responsible for the medical bill if all other payment options (e.g., medicaid, medicare, personal health insurance, a driver's motor vehicle coverage) fall short of covering the full cost of treatment.

FREE 54+ Guarantee Letter Samples in PDF MS Word

UK Divide Between Affluent and Deprived Areas Revealed by

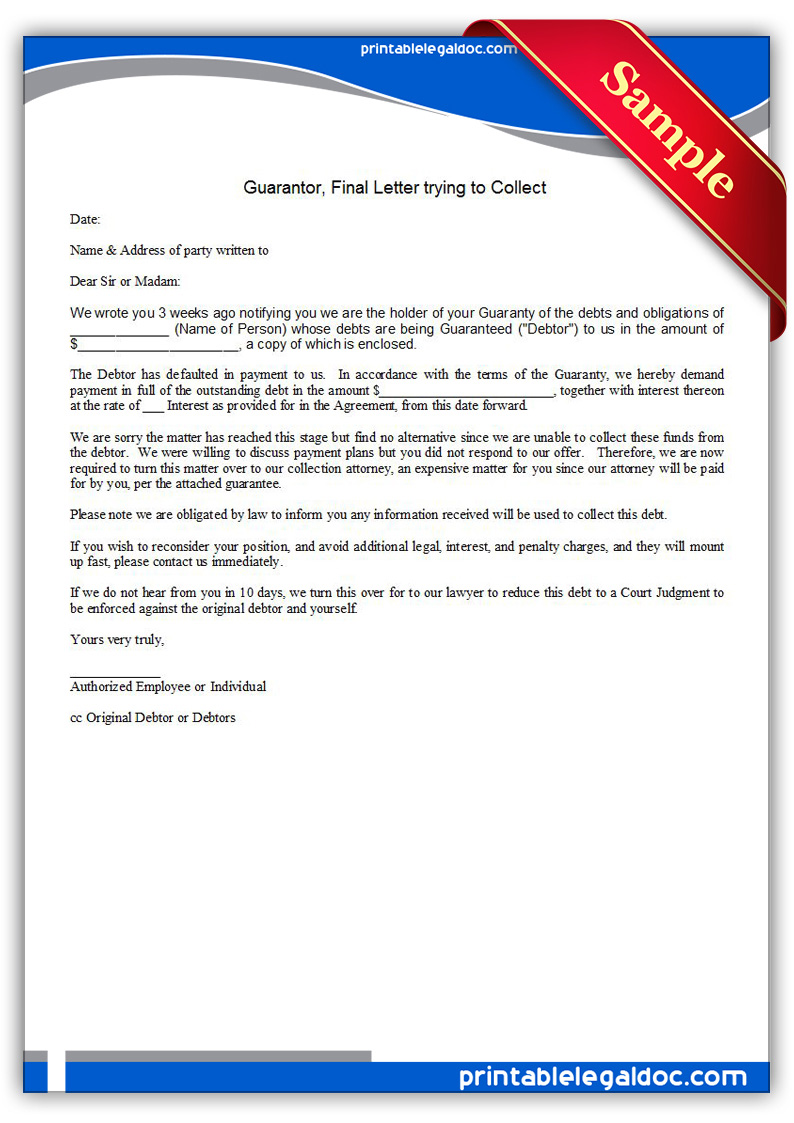

Free Printable Guarantor, Final Letter Trying To Collect

Domestic Energy Guide For Landlords Forbes Advisor UK