That will depend on the damage done to your roof. The first step to having your insurance company pay for a new roof is to submit a claim.

Brand New 21 Ford Transit Custom 2.0 EcoBlue 130ps Low

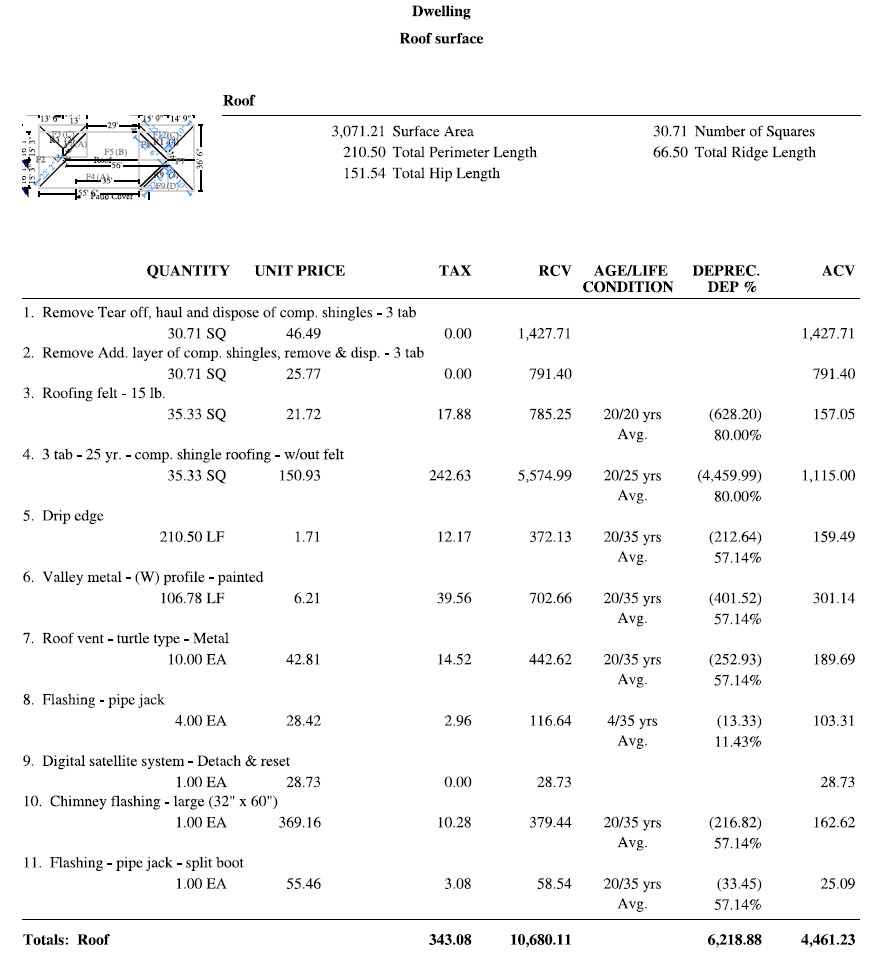

“and the way that works is the insurance company would start out by saying a brand new roof would cost 10,000 (dollars), but your roof is.

Will insurance companies pay for a new roof. Government funded home improvement loans; Therefore fire, vandalism, or damage caused by a major storm are all likely to be covered. Note the date of the damage and take.

You can work accordingly about hiring roofers. Insurance discounts for new roofs. If it is proved that a new roof is really required and that repairs alone cannot fix the damage, then the insurance company can cover the full cost of a replacement.

How to calculate actual cash value and. A leaking roof or destroyed roof may be covered in those instances. Some insurance companies will provide discounts to homeowners after they’ve installed a new roof.

This means you will get a percentage of the replacement cost based on the roof’s material and age. What your insurance policy commonly covers: Does homeowners insurance cover roof replacement?

Feb 4, 2021 / 07:09. We encourage you to be responsible. Proposed legislation would allow insurance companies to not offer full replacement cost coverage on roofs older than 10 years.

7 payment methods for your new roof project cash or check (easiest method) paying all at once with cold hard cash is certainly the easiest and simplest way to get the job done! Not everyone has the means to pay for a new roof with 100% cash (or check), however. For older roofs, damage is more than 25% of the roof can require your insurance company to pay for an entirely new roof based on current florida building code requirements.

In addition, home insurance policies that are “replacement cost” will generally pay two installments for a new roof. After their allotted time frame (usually about 15 days), the insurance agent will let you know if your claim was approved or denied. File a claim once you and your agent have decided to file a claim, submit all relevant documentation — photos of the roof prior to damage, photos of current damage, estimates, and news articles.

If they deny your claim, you can appeal the decision. Most of the times, it can be due to poor workmanship while installing the current roof. Extreme exposure to harsh sunlight, torrential rains or extreme cold can damage the roof.

It won’t pay to install a new roof or repair your current roof if the damage was caused by something like negligence or lack of upkeep. An asphalt shingle roof that’s 15 years old is more prone to leaks simply due to the fact that it’s near the end of its lifespan. You can also request a cost estimate for replacing the roof so that you can decide if the cost of a new roof outweighs the risk of being denied home insurance coverage,” deluise says.

Typically, a homeowner’s insurance policy will cover the cost of replacing your roof when it gets damaged. In general, your insurance coverage will pay out on roof repair and new roof installation which was made necessary by a situation which was out of your control. In many instances, homeowners insurance will pay for a new roof if it is damaged by an extreme weather event such as a lightning strike or snow storm.

Most policies do not cover a roof. Another important issue is whether your insurance company would be covering the cost of a new roof or replacing a full roof. Can i keep insurance money for roof?the simple answer is yes.

After you submit your insurance claim and enlist a roofing company to offer supporting evidence, your insurance company has the discretion to make a decision. It is your money, and you can do with it what you want. However, it often depends on what caused the damage.

To get the best benefit from the insurance company ask how much will the company be ready to pay for a new roof. Repair coverage usually takes into consideration depreciation of the roof. Before the adjuster comes out, it’s important to gather your documents, including a copy of your home’s insurance policy.

The insurance company may send out an adjuster to inspect your roof and make an assessment of the claim. The insurance company will cover it only if the damage was a result of an accident or acts of nature. If you carry a rc policy, your insurance company will cover the cost to replace your roof, minus your deductible.

Now, we’ll look at why a new roof will decrease your homeowners insurance. Insurance payments for roof replacement usually depend on the type of roof covering that has been used, such as composition shingles, tiles, wood, slate, metal, and other materials, along with the type of damage done. What this means to you is that if any particular “roof section” suffers greater than 25% damage, then you are entitled to a replacement of that entire “roof section.”

Homeowners insurance will only pay for a new roof if your roof was damaged or destroyed by a covered peril, such as a windstorm or hailstorm.

5 Tips for Dealing With an Emergency Home Repair Cloud

Roof Cleaning in Houston Pressure Washing Houston

The Great Hail Damage Hoax Shine Insurance Agency