Are you covered against theft? We also offer extra coverage for pet damage, in case you have a cat or dog who is fond of scratching your landlord’s walls.

Lemonade Offers Fast Inexpensive Home And Renters Insurance Powered By Behavioral Economics And Technology No Broke Home Insurance Renters Insurance Lemonade

Lemonade renters insurance covers three main areas of risk that include the following.

Lemonade renters insurance coverage. Bottom line, renters insurance coverage seems to be something we really don’t know how to discuss in simple terms. This just means they’ll be kept in the loop when. Renters insurance endorsements available through each company:

Lemonade offers affordable insurance coverage for homeowners and renters, with homeowners insurance starting at $25 per monthly and renters insurance starting as low $5 per month. The personal liability coverage with lemonade renters insurance starts at $100,000 and would cover all of the legal fees associated with the process. Personal property, personal liability, loss of use (also known as additional living expenses), and medical payments to others are included in state farm's and lemonade's basic renters policies.

When signing up, your landlord might request they be added as an ‘interested party‘ on your policy. Lemonade will be rolling out ebc in the next couple of months in some (but not all) states, so watch this space. For example, if someone fell and broke a bone.

Lemonade’s renters insurance includes the standard coverage above and has these additional options: Lemonade home and renters’ insurance both offer broad coverages with the option to personalize your coverages. Only if you’re getting coverage for items worth more than $1,000.

Do i need to submit details about my personal belongings to get coverage? In terms of liability, lemonade covers you if someone gets hurt on your property. Perhaps you’re one of those people who only head to their apartment to crash after a long day of work (or a long night of fun).

And if your lease specifies that you need renters insurance, well… that’s that. And if your lease specifies that you need renters insurance, well… that’s that. Both companies cover damage from fire, smoke, vandalism, theft, windstorm, water damage and visitor injuries, as well as liability coverage and medical payments.

The good news is that it’s easy to sign up for a renters insurance policy with lemonade, and you’ll thank yourself later if your stuff gets stolen or damaged! When signing up, your landlord might request they be added as an ‘interested party’ on your policy. This covers damage or destruction due to fire, wind, lightning, crime, and water damage too.

Situations where one needs coverage for replacing or repairing personal items, paying bills when you accidentally damage someone’s property, etc are where renters insurance kicks in. Lemonade renters insurance covers the following: Frequently asked questions about lemonade renters insurance.

And most don’t really know the value of it. Lemonade provides insurance for homes. The good news is that it’s easy to sign up for a renters insurance policy with lemonade, and you’ll thank yourself later if your stuff gets stolen or damaged!

Renters insurance, also known as tenant insurance helps a person/family cover for unforeseen situations like theft or personal injuries. Lemonade will cover your legal damages if they choose to sue you. Your policy covers you and your stuff for damages (or ‘perils’ in insurance speak), including theft, fire, vandalism, and water damage from things like a pipe bursting in your travers city apartment.

Coverage for pet damage to a landlord’s property when costs are. While the company offers affordable home coverage, you won’t be able to bundle your policies. To get coverage, you’ll need to list each valuable item with a photo, description and receipt or appraisal.

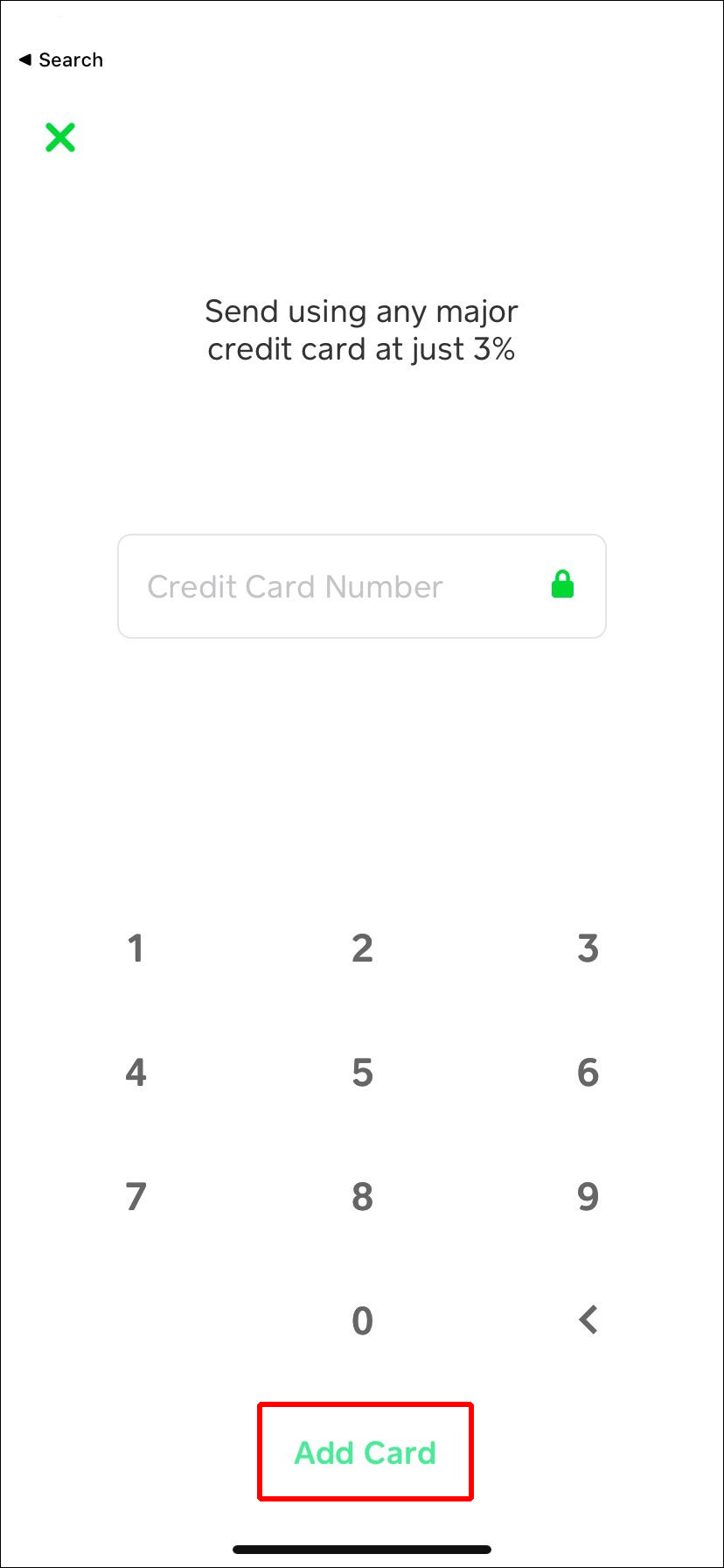

Nice try… renters insurance policies with lemonade can run as low as $5/month, so that’s not a very good excuse to pass up coverage. If you’re adding ebc to your renters policy with lemonade you’ll pay around $2/month extra on your policy (approx $24/year) and with homeowners or condo insurance you’ll pay around $3/month ($36/year). Lemonade doesn’t offer other insurance types, such as auto.

Geico also offers renters insurance; Lemonade renters policies will generally cover liability claims if your dog bites someone outside your household, but some breeds are restricted from coverage in certain states. Many coverage limits, such as those for cameras and jewelry, can be increased at any time.

This just means they’ll be kept in. If you can’t live in your place due to a covered loss or damage, your living expenses will be covered. It’s a shame because it’s one of the most basic investments you can make for a whole lot of peace of mind at a very low monthly cost.

Known primarily for its renters insurance product, lemonade renters policies include coverage for everything you own from damage or loss. You can read more here if you want to know more about what does renters insurance cover. Each company offers typical renters insurance coverage options.

Most renters insurance companies provide similar coverages, including personal property, liability and loss of use. What does lemonade renters insurance in michigan protect me against? However, lemonade sets itself apart by offering its zero everything feature and.

What about hail, lightning, or smoke? There’s tenant water coverage, which protects your apartment from property damage due to a water overflow. Lemonade renters insurance coverage options.

Geico and lemonade are two popular.

Get Your Stuff Covered In 90 Seconds With Lemonade Insurance Zero Hassle No Brokers No Paperwork Lemonade Renters Insurance Insurance

Cheap Rental Insurance Will Be A Thing Of The Past And Heres Why Cheap Rental Insurance Rental Insurance Renters Insurance Renters Insurance Quotes

This Is The Most Legit Review Of Lemonade Insurance If You Are Even Thinking About Renters Or Homowners Insurance Re Millennial Money Lemonade Money Blogging

Lemonade Lemonade Renters Insurance Insurance

The Lemonade App Renters Homeowners Insurance Powered By Tech – Youtube Renters Insurance Homeowners Insurance Insurance

Lemonade Insurance Review Affordable Coverage For Renters And Homeowners Personal Finance Home Insurance Quotes Homeowners Insurance Personal Finance

How It Took Me Three Seconds To Cancel My Lemonade Insurance Policy Insurance Policy Insurance Lemonade

Get Your Stuff Covered In 90 Seconds With Lemonade Insurance Zero Hassle No Brokers No Paperwork Mobile App Design Inspiration Lemonade Renters Insurance

Lemonade Offers Fast And Low Cost Homeowners And Renters Insurance Powered By Technology Honest Culture And A Commi Money Life Hacks Renters Insurance Renter

The Secret Behind Lemonades Instant Insurance Car Insurance The Secret Behavioral Economics

The Lemonade App Mobile App Design Inspiration Lemonade App Design Inspiration

Lemonades Amazing Coverage Protects The Stuff You Own At Home And Everywhere Else Social App Design Website Inspiration Best Landing Page Design

Lemonadezero Renters Insurance Insurance Free Quotes

Lemonade Renters Homeowners Insurance – Free 20 Amazon Gift Card Homeowners Insurance Renters Insurance Renter

The Worlds 1st Live Insurance Policy Watch How It Works Renters Insurance Homeowners Insurance Shocking Facts

What Is An Insurance Declarations Page Insuropedia By Lemonade Renters Insurance Insurance Insurance Comparison

Lemonades Year In Review 2017 Lemonade Renters Insurance Being A Landlord

The Insurance Update Transparency Chronicles Part 3 Mobile App Design Inspiration Infographic App Design Inspiration

Lemonade Insurance Review Affordable Coverage For Renters And Homeowners Renters Insurance Personal Finance Advice Renter